BSE shares gain after stock trades ex-bonus; stock up 30% in 2025

BSE Shares Gain Momentum After Trading Ex-Bonus: What Investors Should Know

The BSE share recently witnessed a noticeable uptick after trading ex-bonus, reflecting renewed investor enthusiasm and strong market sentiment. This development has sparked curiosity among retail investors and market watchers, especially those looking to understand the implications of a bonus issue and how it affects stock performance.

In this article, we will explain what ex-bonus trading means, why the BSE share gained afterward, and what it indicates for current and potential investors.

BSE Bonus Issue: Details at a Glance

India's premier stock exchange operator, BSE Ltd, had earlier announced a bonus issue to reward its shareholders. Here are the key details:

-

Bonus Ratio: 2:1

(Shareholders get 2 bonus shares for every 1 share held) - Record Date: May 17, 2025

- Ex-Bonus Date: May 15, 2025

- Face Value: ₹2 per share

This generous bonus issue significantly increased the number of outstanding shares, which usually results in a stock price adjustment — but in BSE’s case, the share price gained post-adjustment, indicating strong bullish sentiment.

BSE Share Price Performance Post Ex-Bonus

After trading ex-bonus, the BSE share price adjusted accordingly but soon bounced back, gaining over 6% intraday on the National Stock Exchange (NSE). This upward movement shows that investors remain confident in the company’s fundamentals and future growth prospects.

Possible Reasons for the Price Rally:

- Strong Financials: BSE recently posted impressive quarterly results, with rising revenue from equity trading and new listings.

- Increased Liquidity: Bonus shares make the stock more affordable, attracting more retail participation.

- Positive Sentiment: The bonus issue is often seen as a sign of management confidence and shareholder-friendly behavior.

- Technical Buying: Traders may see short-term opportunity post-adjustment.

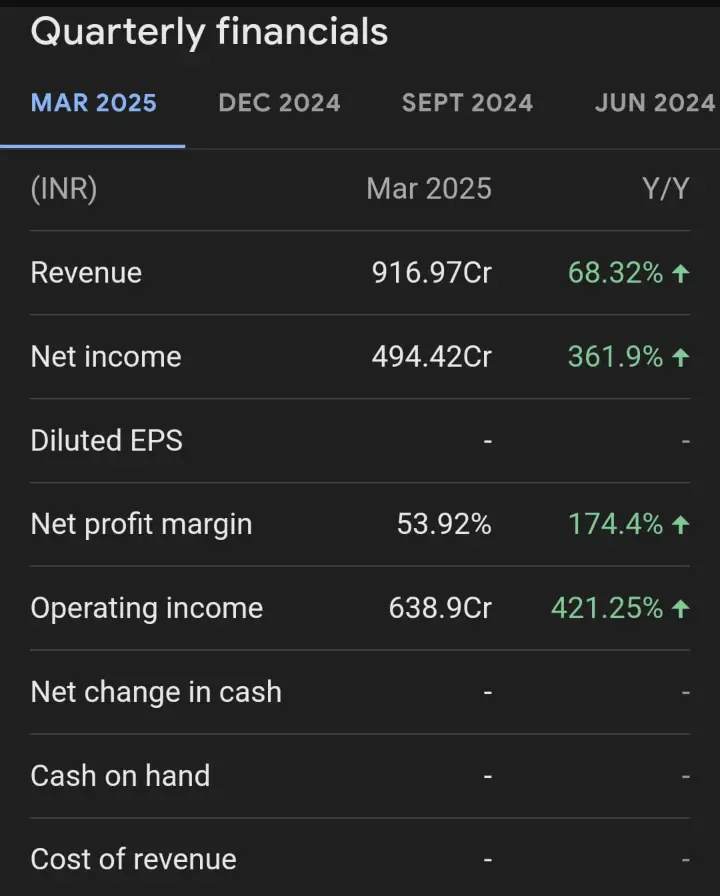

March 2025 Quarterly Result

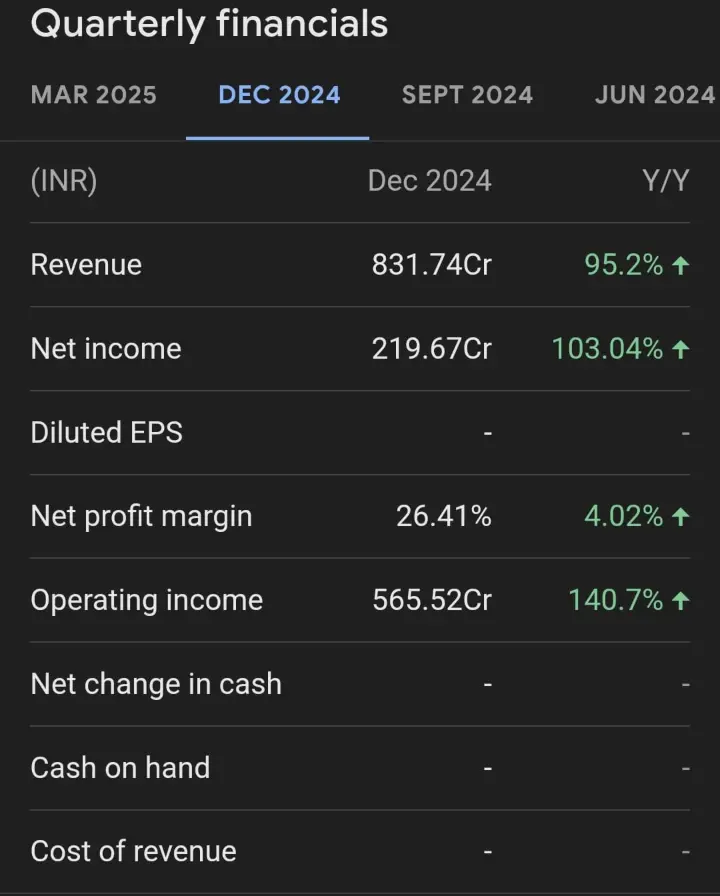

December 2024 Quarterly Result