APLD Stock Surges Following Major AI Infrastructure Deal

On June 2, 2025, Applied Digital Corporation (NASDAQ: APLD) announced two 15-year lease agreements with CoreWeave, an AI-focused cloud service provider backed by Nvidia. Under these agreements, Applied Digital will deliver 250 megawatts (MW) of critical IT load to host CoreWeave's AI and high-performance computing infrastructure at its Ellendale, North Dakota data center campus. The deals are expected to generate approximately $7 billion in revenue over the lease term.

Following the announcement, APLD stock experienced a significant surge, reflecting investor confidence in the company's strategic direction and growth prospects.

Strategic Implications of the CoreWeave Partnership

The partnership with CoreWeave marks a pivotal moment for Applied Digital as it transitions into a data center real estate investment trust (REIT). The Ellendale campus, designed to host up to 400 MW of critical IT load with potential scalability to 1 gigawatt, positions Applied Digital at the forefront of AI and high-performance computing infrastructure.

CoreWeave retains the option to access an additional 150 MW at Ellendale, further solidifying the site's role as a scalable hub for expanding AI workloads.

Applied Digital (APLD) Stock Overview

As of June 2, 2025, Applied Digital Corporation (NASDAQ: APLD) is trading at $9.68, marking a significant 38% increase following the announcement of a major AI infrastructure deal.

Key Stock Metrics:

- Current Price: $9.68

- Day Range: $6.66 – $9.94

- 52-Week Range: $3.01 – $12.48

- Market Cap: $1.53 billion

- Volume: Approximately 109 million shares traded today

$7 Billion CoreWeave Deal Fuels Stock Rally

Applied Digital has entered into two 15-year lease agreements with CoreWeave, providing 250MW of critical IT load for AI and high-performance computing at its Ellendale, North Dakota data center campus. This deal is expected to generate approximately $7 billion in revenue over its term.

Deal Highlights:

- First 100MW data center: Operational by Q4 2025

- Second 150MW facility: Completion expected by mid-2026

- Optional Expansion: CoreWeave can add another 150MW, potentially increasing the campus's capacity to 550MW

This strategic partnership positions Applied Digital as a significant player in the AI data center space, catering to the growing demand for high-density computing solutions.

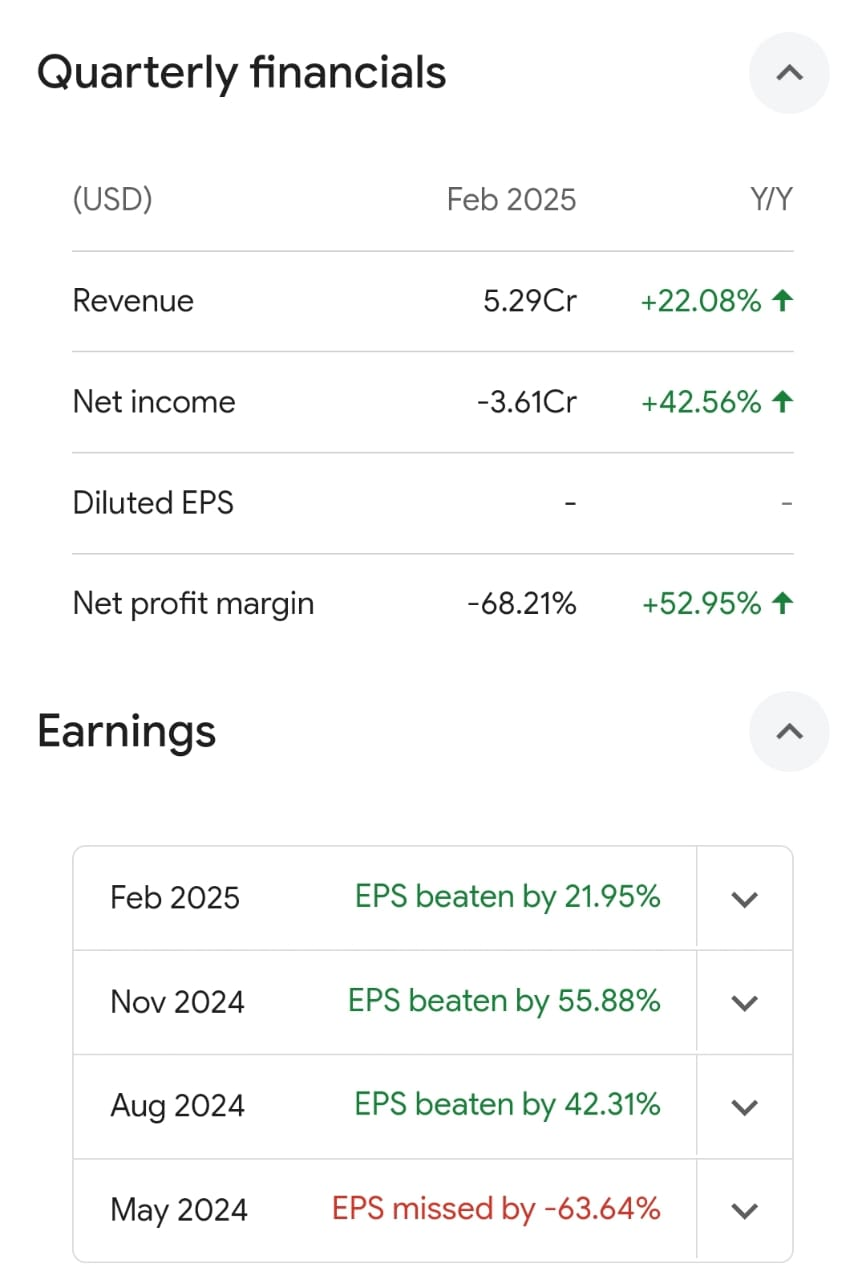

Financial Snapshot: Q3 FY2025

For the quarter ended February 28, 2025, Applied Digital reported:

- Total Revenue: $52.92 million (up 22.08% YoY)

- Cloud Services Revenue: $17.8 million (up 220% YoY)

- Adjusted EBITDA: $10 million (an 878% increase)

- Cash & Equivalents: $261.2 million

- Total Debt: $689.1 million

Despite the impressive growth in cloud services, the company's substantial debt load remains a point of concern for investors.

Valuation Metrics

- Price-to-Earnings (P/E) Ratio: Currently negative at -6.69, indicating that the company is not profitable on a trailing twelve-month basis.

The negative P/E ratio reflects ongoing investments and expansion efforts, which, while impacting short-term profitability, may position the company for long-term growth.

Upcoming Earnings

Applied Digital is scheduled to report its next quarterly earnings on August 27, 2025.